Mastercourse in

Equity Research & Valuation with Internship

Conducted by Vinit Bolinjkar

About

School of Market studies was born out of my passion for teaching and giving back to society.After being in the equities trading for over 29 year & having spent the previous ~12 years as the Head of Research Head, Equities at a premiere brokerage, I realized that something was amiss in the way Institutions teach equity research.Clearly there was a disconnect between the real life application and the theoretical knowledge disseminated at collegeAt School of Market Studies, my precise aim is to do just that. Empower students with a more practical application of the tenets of research, valuation & forecasting. **Taught lucidly such that even a first-timer to the world of investing understands.The end goal is to make the subject of Investing and valuation more fun than being an arduous task.** E-mail Id - [email protected]Now you don't need a costly MBA / CFA degree or pay for the expensive services of an expert.

Interested? Get in touch!

New Batch Starts on 17 January

Course Framework

Course duration is 9 weeks / 2 classes per week

Thursday 7:30 pm – 9:30 pm

Saturday 3:00 pm - 5:00 pm

Only course that offers four months of internship support

Taught via __webinar __ along with detailed stock picking methodology (with exposure to various forms of valuation)

Video content available for offline viewing for upto a year. PDF notes are also provided.

Proprietary Interactive Live Coaching methodology is designed for accelerated learning of the 12 Dimensions Investment Tool Box

The Investment Tool Box ensures that stock which passes the rigorous test of its 12 Dimensions has an extremely high probability of turning into a multibagger.

Any stock that clears our 12 Dimensions Investment Tool Box has an extremely high probability of turning out to be a multibagger.The Dimensions are as listed -

1. Leadership team, Stake holders and growth hunger

2. Business Prospects & Opportunity Heat Map

3. Business Readiness & growth curve

4. Peer Set analysis & evaluation

5. Past performance analysis & Scenario Forecasting

6. Progress Tracking , monitoring, validation and reassessment

7. Operating Leverage & Moat

8. Valuation Potential & re-Rating

9. Criteria of elimination for stock selection

10. Scuttlebutt, Ardour & Zeal

11. Mindset of Multibagger Investing

12. 6D investing (for expoential technologies)

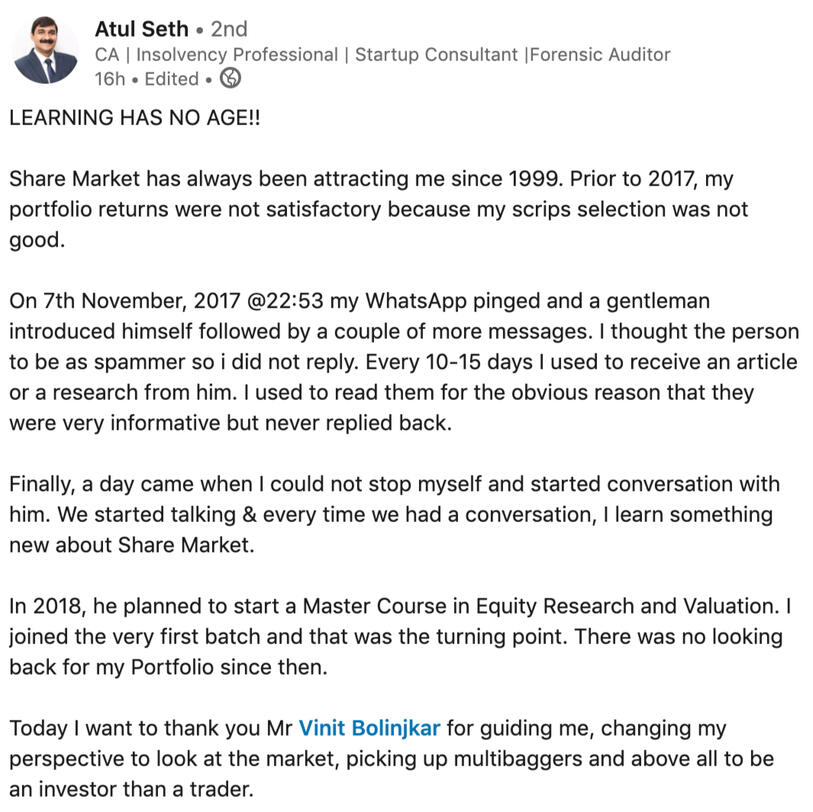

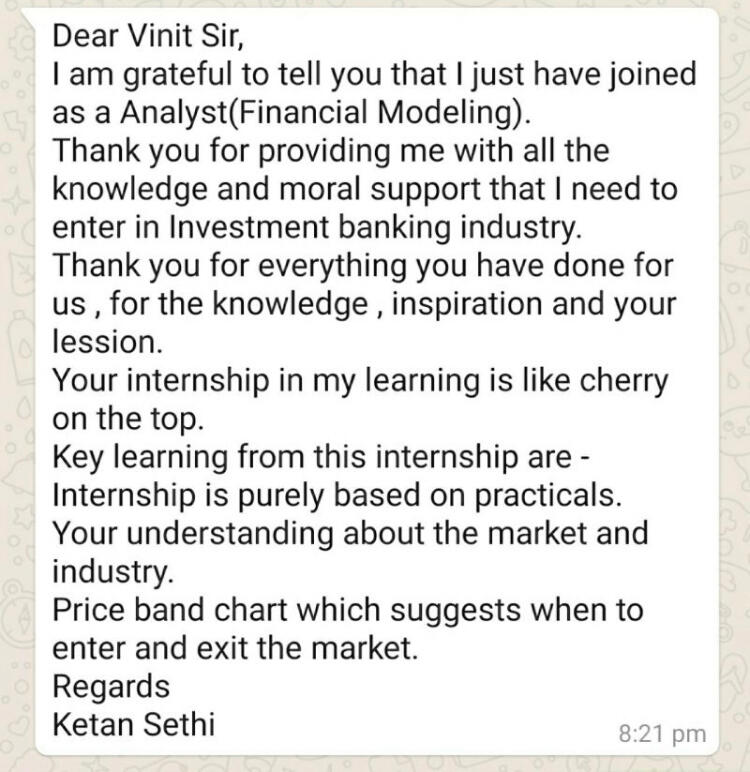

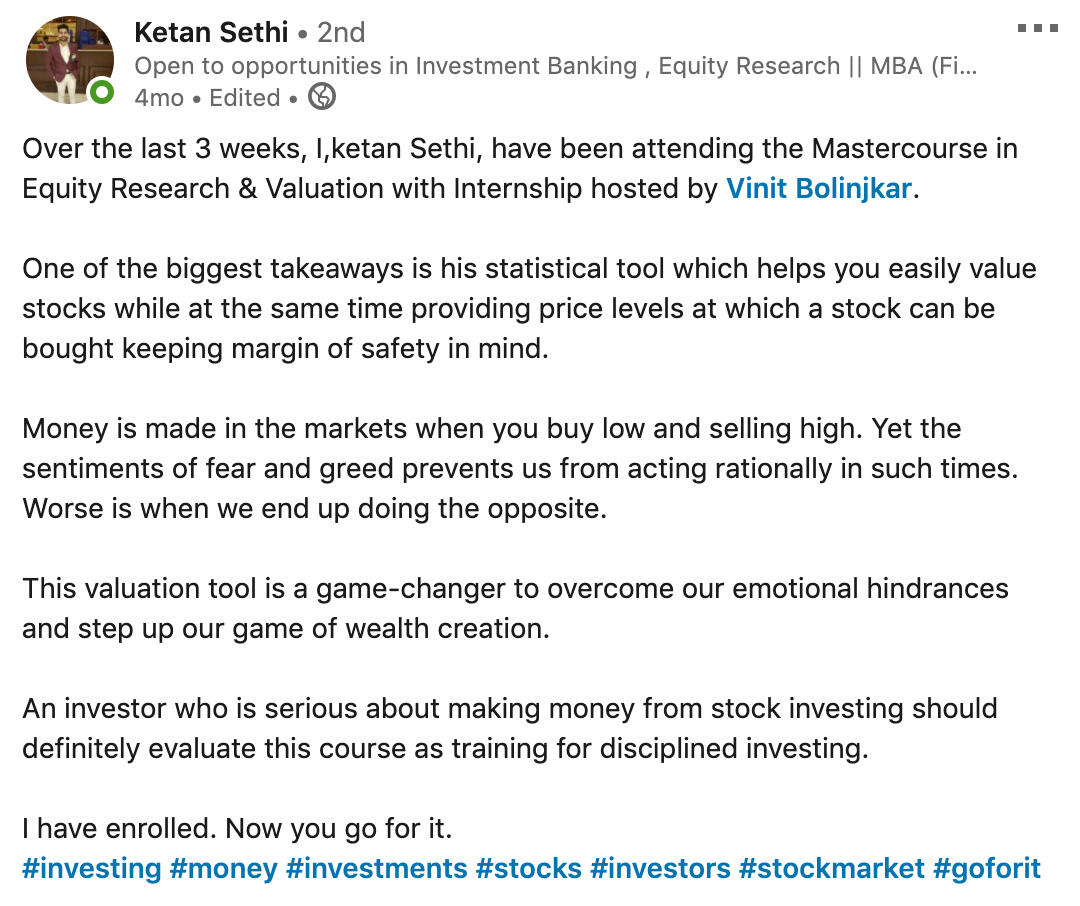

Testimonials

Hi Vinit Sir,Thanks for the extremely practical and knowledgeable first session on Equity Research and Valuation. The Macro Economic Overview of Markets along with the relation to Pascals Law was very novel and insightful. Also I found the practical and real life scenario examples which you illustrated very interesting.

There is Theory and Practical and a combination of both is required and I feel myself lucky to be tutored with a practical approach.Eagerly waiting for the future sessions.

Once again Thank you for taking out time to tutor us.

Rushabh Kothari

I had recently signed up for the mastercourse by Vinit sir. Though the first session was introduction. He emphasized on the importance of selecting a company with a sound management and how important a promoter is to the success and growth of the company. Taking examples from the likes of Raymond and jyothi labs, I really consider myself lucky for getting this opportunity to learn from a market veteran. He taking the time to answer even the most basic of questions exemplifies his love for teaching. Looking forward to continue learning under his guidance.

Bharath Swaminathan

You are going to empower me with the knowledge of investing in the equity market in a way that will help me to create wealth on my own while minimizing associated risk, know upside potentials of a stock and besides this will also help me to lend various interviews to start a career in equity.

Preeti Agarwal

I am a first year management student and I always look for new opportunities to build my acumen in the financial domain. I came across this master course on LinkedIn and thought it'd be a great value addition to my skillset. I'm writing this after the very first lecture of the course and I can already tell that I'm very glad to have opted for this course. The lecture started with the basic introduction and a brief understanding of how the markets actually work. Sir used many real life examples to make it more relatable and easy to comprehend. Sir also addressed to a whole lot of questions with complete satisfaction. Although the session seemed a little fast paced, I think it'll be compensated with the replays provided. He even stressed on revising all the points discussed so as to keep everybody on the same page and running. Overall, I am super excited to attend the further lectures and I'm confident about the value addition I'll obtain after its completion!

Parth Bagul

Webinar Learning Series

Hindustan Unilever Limited - Equity Research & Valuation

Nestle India- Equity Research & Valuation

Voltas - Equity Research & Valuation

Marico - Equity Research & Valuation

Varun Beverages - Equity Research & Valuation

Get in touch

Frequently Asked Questions | FAQ's

Get informed before you join!

For whom is this course designed ?

What all softwares are required for the course ?

What is the aim of the internship and how is it carried out ?

What all factors are covered in the course ?

If someone can't attend the classes live, should one take up the course ?

What is the Webinar Learning series ?

Can working professionals do this course and the internship ?

Why should one choose the Equity Research and Valuations course ?

For whom is this course designed ?

What all certificates, we will get after completion of the course?

Click to meet THe TEAM

THe Team

VINIT BOLINJKAR -LEAD TRAINER

Hrishikesh BOLINJKAR -LEAD TRAINER

Akansha Sinha - Technical Head

Himanshi goel - Marketing Head